It’s no secret that successful trading involves reducing risk. The Trade Scalper focuses on many small moves throughout the day so that you are in control of multiple trades with smaller stops as compared to other DayTradeToWin methods. You’ll see many long and short signals throughout the day. The signals are entirely based on price action. The Trade Scalper can be used standalone or in combination with other DayTradeToWin methods, such as the Atlas Line.

The longer you’re in a trade, the more you’re exposed to potentially adverse conditions. A targeted approach is preferred by expert traders.

When the price action conditions are just right, execute the trade without hesitation. Minimize risk for each trade. Be adaptable. Be open to trade again if the conditions are conducive. These are the rules many professional traders live by.

The Trade Scalper is no different in its approach. This powerful price action scalping technique has been perfected by John Paul over many years of refinement.

What you’ll be learning is a specific, rule-based approach to determine what your profit target and stop loss should be based on current market conditions and how to manage each trade.

The Trade Scalper can be used on many types of markets. It’s own of the most versatile day trading systems DayTradeToWin offers.

How many times have you seen a group of candles stuck in a range and thought, “How can I trade this? There’s hardly a trend. If I’m going to trade today, I’m going to have to work within smaller channels.” This is one of the many market conditions the Trade Scalper can help with.

Alternatively, what about those magical trending days, where you say to yourself, “Wow! If I could have only got in multiple times and rode the trend up…” Again, that’s another condition the Trade Scalper can help with.

So, you see, the Trade Scalper can help with the two most common trading conditions: relatively flat and trending markets. You should also know the Trade Scalper can be used on a variety of futures and other financial instruments. You’ll be working with the E-mini S&P 500 primarily. However, you’re taught how to adapt to other markets, such as the YM, NQ

For over a decade, DayTradeToWin has created trading methods designed for everyday people to follow and replicate using their own charts. No supercomputers are needed. The style of trading you’re taught is meant to be traded by you, a real person, using your home or office computer. The signals can be customized in appearance for great visibility. Once you see a signal, you may place a trade according to your understanding of the method.

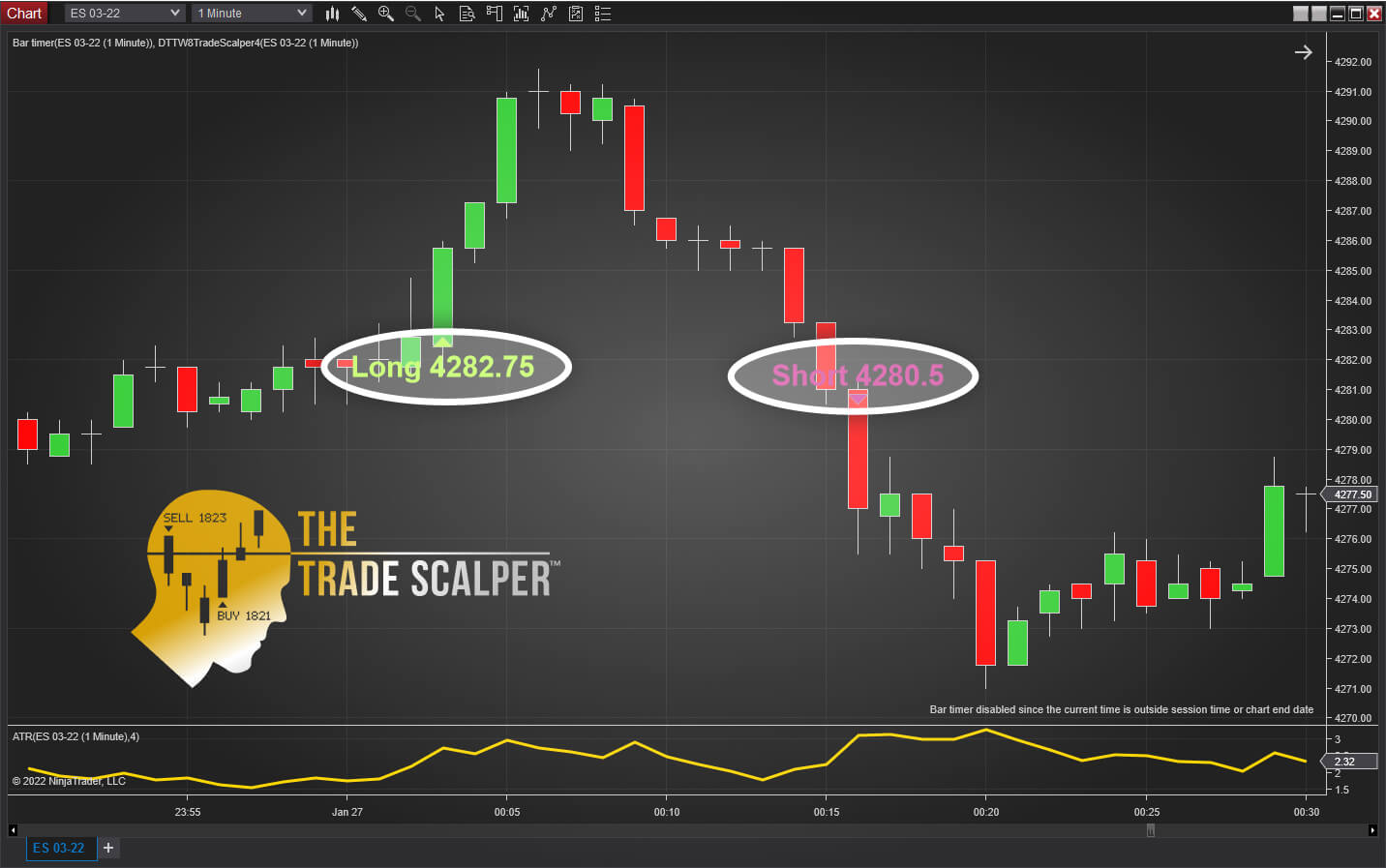

Like other DayTradeToWin trading systems, the Trade Scalper is based around price action “proving” that it’s ready to be traded. A trade only occurs when a certain price action pattern is present. The Trade Scalper indicator software takes care of identifying this pattern automatically for you. You have to be the one to place the trade. This puts you in control.

If the markets are too fast or too slow, or perhaps you just want to trade something other than the E-mini S&P 500, the Trade Scalper is an excellent choice. Because it is a scalping method, it can be traded in conditions of lower volatility than other systems. The Trade Scalper has traditionally been used on a 1-Minute chart, but a 2-Range, 5-Minute, and other chart types are viable options.

You may have seen the Trade Scalper used as a standalone system or in conjuction with the Atlas Line, Roadmap, or other DayTradeToWin software. Some traders like having a longer-term method to further validate the Trade Scalper signals. Who doesn’t like a confirming opinion? DayTradeToWin’s 8-Week Mentorship Program is the only way to get everything in one complete package.

Here’s a sneak peak at the Trade Scalper digital course…

Remember, a single day is not a good measure of trading performance. Professional traders look at results from monthly, quarterly, and annual perspectives. Any good experiment or period of testing involves reducing the number of variables. With too many indicators on a chart informing your day-to-day decisions, in 30+ days time, will you really know what caused the ups and downs in your performance? Use a single trading method or use those that work together harmoniously to form one complete plan.